Technoglitch

Core Member

For years, Tata Teleservices has been the laggard in the $100 billion Tata group. In spite of the huge investments made by Tata Sons, the unlisted company is way behind the trio of Bharti Airtel, Vodafone and Idea Cellular in the sweepstakes.

It started with CDMA services and expanded into the GSM platform in 2008 when it also tied up with NTT DoCoMo of Japan. Though it had got a licence to operate in all the 22 circles, it was allotted spectrum in only 18. One of those four circles where it didn't have spectrum was Delhi, a huge market.

In February 2012, the Supreme Court cancelled all the licences given out by the United Progressive Alliance government in 2008 under the first come first serve policy, after a report by the Comptroller & Auditor General said it had caused a loss of up to Rs 176,000 crore to the government. Tata Teleservices lost three circles.

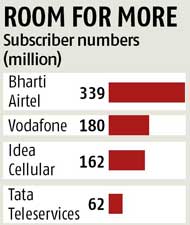

That perhaps explains why the company's 62 million subscribers are far below those of Bharti Airtel (339 million), Vodafone (180 million) and Idea Cellular (162 million). Its average revenue per user of Rs 170 per month as against the industry average of Rs 200 means its customers are concentrated at the lower end of the market.

The comeback plan

One of the first steps taken by the company in the last three years was to shrink its CDMA-based services which had failed to click with the customers. The company also bought spectrum in the Delhi circle - one of the most lucrative markets where it did not have any presence.

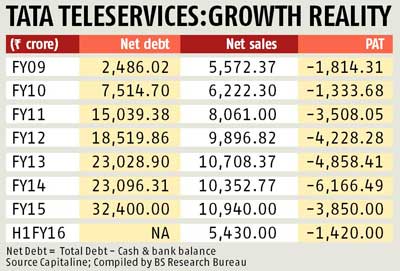

At the same time, the company also started selling its assets so that it could deleverage its balance sheet and cut jobs across the board. In October, Tata Teleservices reduced its stake in telecom tower company Viom Networks from 53 per cent to 33 per cent for Rs 2,800 crore. This money is expected to flow in by the first quarter of 2016-17 and the company will use the funds for its capital expenditure and debt repayment. It plans to sell the rest of the shares in Viom Networks at a later date.

The company also took steps to improve its operations. Last year, the company bought 3G spectrum in nine circles for Rs 5,864 crore. However, with data services growing at a faster pace than voice and action moving to 4G-LTE services, it is not clear if Tata Teleservices will be able to make a dent with 3G spectrum in just nine circles.

Tata Tele shows signs of coming out of the woods | Business Standard News

It started with CDMA services and expanded into the GSM platform in 2008 when it also tied up with NTT DoCoMo of Japan. Though it had got a licence to operate in all the 22 circles, it was allotted spectrum in only 18. One of those four circles where it didn't have spectrum was Delhi, a huge market.

In February 2012, the Supreme Court cancelled all the licences given out by the United Progressive Alliance government in 2008 under the first come first serve policy, after a report by the Comptroller & Auditor General said it had caused a loss of up to Rs 176,000 crore to the government. Tata Teleservices lost three circles.

That perhaps explains why the company's 62 million subscribers are far below those of Bharti Airtel (339 million), Vodafone (180 million) and Idea Cellular (162 million). Its average revenue per user of Rs 170 per month as against the industry average of Rs 200 means its customers are concentrated at the lower end of the market.

The comeback plan

One of the first steps taken by the company in the last three years was to shrink its CDMA-based services which had failed to click with the customers. The company also bought spectrum in the Delhi circle - one of the most lucrative markets where it did not have any presence.

At the same time, the company also started selling its assets so that it could deleverage its balance sheet and cut jobs across the board. In October, Tata Teleservices reduced its stake in telecom tower company Viom Networks from 53 per cent to 33 per cent for Rs 2,800 crore. This money is expected to flow in by the first quarter of 2016-17 and the company will use the funds for its capital expenditure and debt repayment. It plans to sell the rest of the shares in Viom Networks at a later date.

The company also took steps to improve its operations. Last year, the company bought 3G spectrum in nine circles for Rs 5,864 crore. However, with data services growing at a faster pace than voice and action moving to 4G-LTE services, it is not clear if Tata Teleservices will be able to make a dent with 3G spectrum in just nine circles.

Tata Tele shows signs of coming out of the woods | Business Standard News